Motive to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by business specialists and meticulously reviewed

The very best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Chainlink’s token, LINK, has barely budged this month. It sits in thirteenth place by market cap after choosing up simply 3.8% since Might 1. Its value hovers below $12 at occasions, although some reviews put it close to $16 when markets final ticked. That combined image raises questions on whether or not LINK can maintain its spot.

Associated Studying

Cross-Chain Push Comes To Solana

Based on revealed updates, Chainlink rolled out its Cross-Chain Interoperability Protocol on Solana on Might 19, 2025. This characteristic goals to let builders faucet into over $18 billion in property throughout chains.

The improve is supposed to assist Solana’s DeFi world hyperlink up with Ethereum, Polygon, Avalanche and others. It exhibits Chainlink’s group isn’t ready round for the value to climb.

⬡ Chainlink Adoption Replace ⬡

There have been 16 integrations of the Chainlink normal throughout 6 companies and 16 completely different chains: Arbitrum, Avalanche, Base, Bitlayer, BNB Chain, Celo, Ethereum, opBNB, Optimism, Polygon, Ronin, Rootstock, Scroll, Solana, Sonic, and ZKsync.

New… pic.twitter.com/j3cnAnc3UC

— Chainlink (@chainlink) Might 25, 2025

New Integrations Add Momentum

Based mostly on reviews from the Chainlink group, there have been 16 recent integrations of its requirements. These span six service varieties and embrace assist on Arbitrum, Avalanche, Base, BNB Chain, Ethereum, Polygon, Solana and ZKsync.

Developer exercise is on the rise. However that development hasn’t sparked huge strikes within the LINK market but. A $10.4 billion market cap nonetheless feels sturdy. But the token’s flat efficiency places strain on its rating.

Resistance Zones Form Outlook

Merchants eye key hurdles on the LINK/USDT chart. First up is a wall at $20, a stage the place sellers have stepped in earlier than. A push previous that might ship LINK towards a $25–$26 space. Past lies a mid-term goal of $28–$30, matching late-2024 highs.

Quantity spikes in April did set off a 14% climb, pointing to doable repeat motion. However bears nonetheless have a say. The MACD line sits below its set off line, although the hole is slender. Histogram bars are flat, hinting that promoting drive is likely to be fading. A crossover may spark recent shopping for.

$LINK‘s downtrend channel is about to interrupt out.

This rise is more likely to proceed easily to the $36.5 stage, the place there’s a promoting wall. pic.twitter.com/CaN2agtchk

— CW (@CW8900) Might 26, 2025

Breakout Indicators

In the meantime, LINK is displaying indicators of breaking out of its downtrend channel, sparking bullish momentum amongst merchants. Analysts observe {that a} clear breakout may push LINK towards the $36.5 stage, the place a significant promoting wall sits.

The transfer follows elevated developer exercise and Chainlink’s CCIP launch on Solana. If consumers maintain momentum, LINK could rally easily—however the $36.5 resistance may check the power of this breakout.

Flat Forecasts Hold Hopes Modest

Technical indicators are combined. LINK’s one-month forecast exhibits a 0.61% achieve by June 26, 2025, touchdown it round $15.64. That outlook comes with a “Impartial” studying on market sentiment.

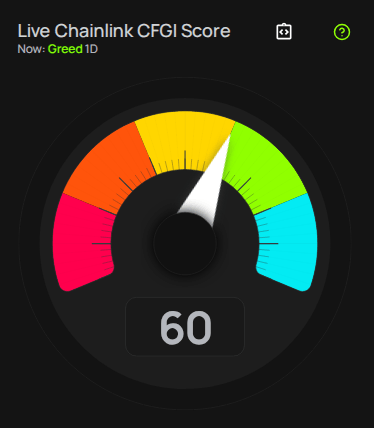

Supply: CFGI

The Worry & Greed Index sits at 60, an indication of Greed. Up to now 30 days, LINK had 12 inexperienced days out of 30 and noticed 6.40% volatility. All that factors to modest strikes reasonably than wild swings.

What Comes Subsequent For LINK

Chainlink’s core objective stays the identical: energy a decentralized oracle community that feeds real-world knowledge into blockchains. These efforts matter for tasks that want value feeds, random numbers or cross-chain messages.

Associated Studying

If an enormous DeFi protocol adopts CCIP or a significant hack bounty will get paid out, LINK may see recent demand. Till then, the token could drift. Watch the value close to $11 and $20.

Featured picture from Unsplash, chart from TradingView