The crypto market sentiment improved this week, with a number of giant cryptocurrencies recording double-digit beneficial properties. Bitcoin’s rally previous the $95,000 resistance is the spotlight, with altcoins like Official Trump and Sui outperforming most others.

Bitcoin’s decoupling from inventory, the comeback of the digital Gold narrative, and Trump’s softening stance on tariffs supported this week’s beneficial properties.

Bitcoin, altcoin weekly efficiency

Bitcoin (BTC) is at present hovering underneath $95,000, a key stage for essentially the most distinguished cryptocurrency. Eventually test Saturday, BTC was down 0.45%, buying and selling at round $94,358.49.

Observers famous that it recovered from its most up-to-date flash crash, the place the asset slipped to its lowest stage in almost 5 months.

With Bitcoin again above key help zones, merchants eye the $100,000 milestone and a re-test of the all-time excessive within the coming weeks. Demand for crypto stays robust, and sentiment is popping constructive. For the primary time in a number of weeks, merchants are “grasping”, as seen on the Concern & Greed Index at Different.

Altcoins adopted in Bitcoin’s footsteps and recovered losses. Most cryptos posted double-digit rallies this week, erasing losses from the BTC flash crash within the second week of April 2025.

TRUMP, SUI outperform

The Official Trump token (TRUMP) and Sui (SUI) are two tokens that outperformed most different altcoins with their seven-day beneficial properties, 79% and 70% respectively. Technical indicators for the 2 tokens present chance for an extension of their rallies within the coming weeks.

The worth of President Donald Trump’s meme coin surged solely after it was introduced that the highest 220 holders can be invited to a gala dinner with him subsequent month, with the highest 25 additionally attending a VIP reception and White Home tour.

The White Home crypto workplace mentioned it isn’t related to the occasion, and the dinner might personally profit the Trump household by boosting the coin’s worth.

Regardless of the rally, $TRUMP stays properly beneath its $75 peak from January.

Nonetheless, as threat urge for food grows amongst merchants, TRUMP and SUI holders stand to achieve and see profit-taking alternatives if the upward momentum within the two tokens is sustained.

Bitcoin and altcoins are set to shut a powerful week whereas Trump softens his stance on tariffs and maintains help for U.S. Federal Reserve Chair Jerome Powell. The digital Gold narrative is making a comeback as Bitcoin decouples from tech shares and merchants’ portfolios may gain advantage from including a safe-haven asset structurally totally different from equities.

Institutional demand is up

Whereas altcoins steal the limelight with double-digit rallies, institutional traders warmed as much as Bitcoin and U.S. Spot Trade Traded Funds recorded the strongest week of inflows in 2025.

Institutional shoppers are pouring capital into Bitcoin Spot ETFs and gearing for the upcoming approval of altcoin ETFs, with a pro-crypto SEC and Chair Paul Atkins in workplace.

As U.S.-China tensions cool, establishments quietly drive demand for BTC, citing two key properties of the asset, “inflation resistance,” and its “shortage.”

Sovereign wealth funds, banks and asset managers are all in favour of Bitcoin, whereas establishments like Semler Scientific observe within the footsteps of Michael Saylor’s Technique in 2025.

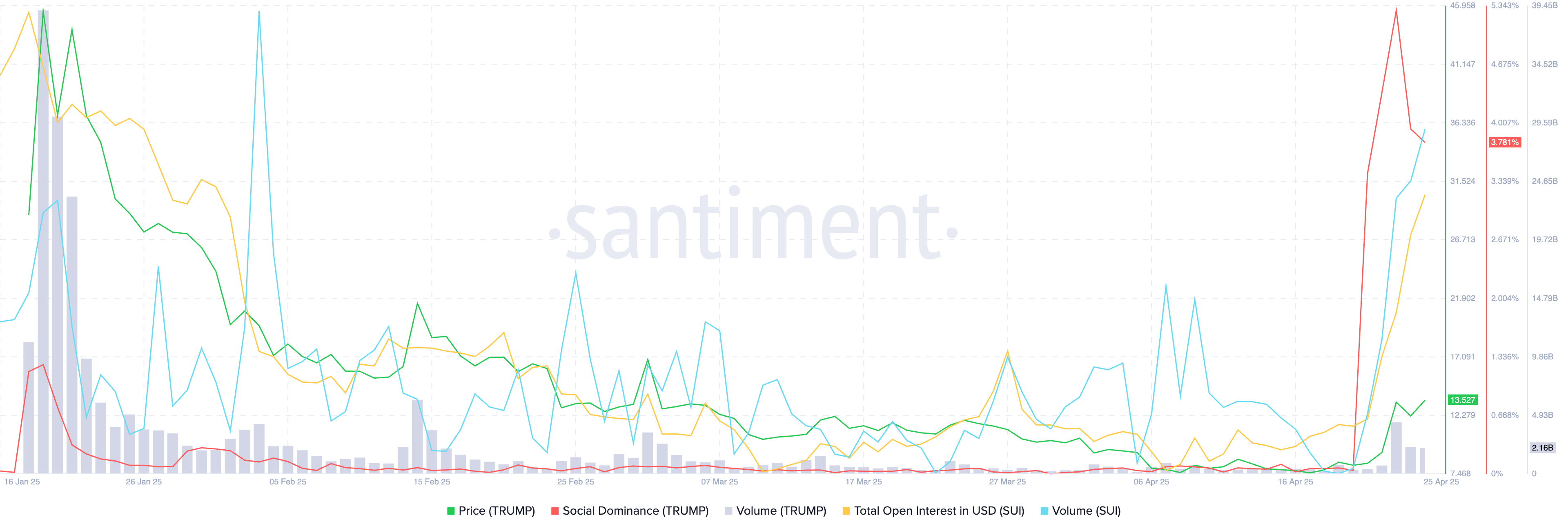

Santiment exhibits…

On-chain knowledge from Santiment exhibits TRUMP famous a big spike in social dominance and an uptick in commerce quantity — doubtless as a result of gala invite.

For SUI,, there was a major improve in Open Curiosity as the overall worth of open positions in SUI throughout derivatives exchanges, and an increase in quantity.

On-chain indicators help the beneficial properties in TRUMP and SUI and counsel an prolonged worth rally within the coming weeks.

TRUMP rallied about 16% prior to now 24 hours; SUI is down roughly 8.35% prior to now 24 hours.

TRUMP, SUI worth forecast

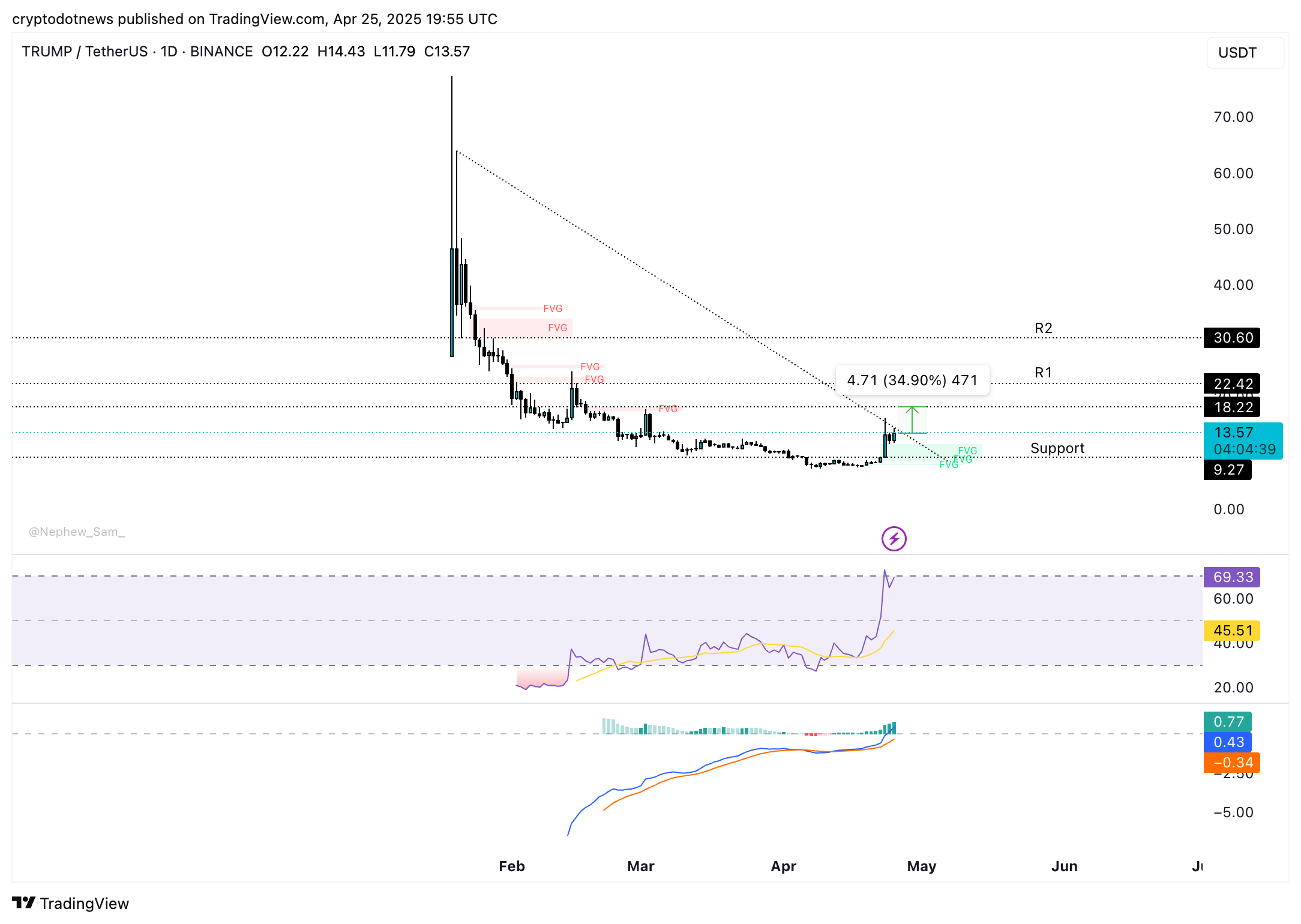

TRUMP has been consolidating underneath resistance at $18.22 for the previous month. Two key momentum indicators on the every day timeframe, RSI and MACD help beneficial properties in TRUMP. RSI reads 69, shy of the “overvalued” or “overbought” stage at 70 and MACD flashes consecutively taller inexperienced histogram bars above the impartial line.

If TRUMP’s constructive momentum is sustained, the meme coin might flip resistance into help and rally 34% to check $18.22, a sticky stage for the token. Two key resistances on TRUMP’s path because it breaks right into a rally are $22.42 and $30.60.

SUI trades at $3.5791 on the time of writing. The DeFi token might lengthen its rally by one other 12% and check resistance at $4.0105, for the primary time since February 2025. The $3.8588 stage, a decrease boundary of a Truthful Worth Hole on the every day worth chart, is a hurdle within the token’s uptrend.

SUI might discover help within the FVG between $2.7488 and $2.8950, within the occasion of a correction.

The MACD, one of many two key momentum indicators, helps beneficial properties within the token and implies an underlying constructive momentum in SUI’s uptrend.

RSI is at present within the “overbought” zone above 70, this generates a promote sign. Nevertheless, except different indicators level at a pattern reversal, SUI might lengthen its worth rally.

Why altcoins might rally quickly

Bitcoin’s current beneficial properties and return above the $95,000 stage may very well be a fleeting second available in the market cycle since on-chain knowledge exhibits that BTC demand continues to be contracting, although not as quick as earlier than.

CryptoQuant knowledge exhibits that momentum from new traders has dropped sharply and hit its lowest stage since October 2024.

Whereas ETF flows could have steadied for now, liquidity development is beneath market expectations and this isn’t a recipe for a sustained worth rally in Bitcoin.

A slowdown in Bitcoin might direct capital to altcoins, paving method for a rally, sustained beneficial properties in meme tokens and different cryptocurrencies till BTC demand rises.

Disclosure: This text doesn’t characterize funding recommendation. The content material and supplies featured on this web page are for instructional functions solely.