Disclosure: This text doesn’t symbolize funding recommendation. The content material and supplies featured on this web page are for instructional functions solely.

As Goldman Sachs masses up on secure, regulated Bitcoin ETFs, crypto-native whales are chasing bolder bets, like APORK, a memecoin mixing virality with actual utility.

In February 2025, we noticed that Goldman Sachs make a major funding in Bitcoin ETFs, because it elevated its holdings within the iShares Bitcoin Belief (IBIT) by 28%. For a agency that manages billions in shopper capital, Bitcoin (BTC) through ETF is the most secure solution to provide publicity within the crypto market to its shoppers.

Why does Goldman Sachs wager on the BTC ETF?

As a result of it’s probably a safer wager. It’s regulated by the SEC, and the property are custodied by trusted third events like Coinbase. In reality, the whole lot from liquidity to tax therapy is structured in a manner that they don’t contact non-public keys. They usually do all of it in clear, auditable methods.

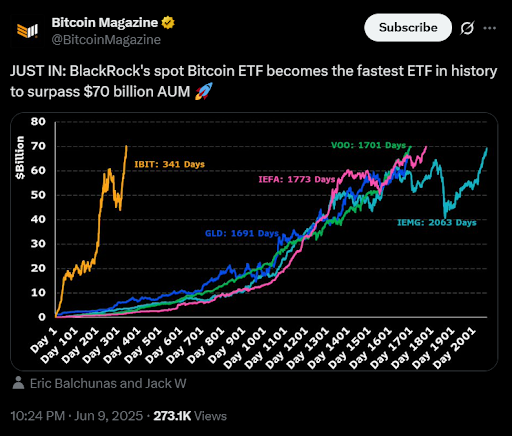

For companies as massive as Goldman Sachs, it’s about parking massive quantities of cash into an asset they imagine is now legitimised. In reality, in early June, we noticed that the Bitcoin ETF surged previous $70 billion in property below administration (AUM), reaching the milestone in simply 341 buying and selling days.

However the Telegram whales, or the massive analysts that assess communities of fast-moving non-public teams stuffed with crypto-native gamers, don’t have to stay to much less dangerous property simply to play it secure. Many are leaning towards one thing a lot louder, sooner, and looser: memecoins with utility, like APORK.

What’s it about APORK that pulls the Telegram Whales?

What we now have seen through the years is that whales don’t have compliance departments and don’t want to attend for ETFs. What they care about is multipliers, narrative momentum, early entry, and recognizing traits.

What makes it stand out?

Its core thought is to construct a memecoin that monetizes consideration, not simply hypothesis. APORK does this by means of three layers of engagement:

- Meme tradition: It makes use of humor, branding, and virality to draw consideration.

- By means of GambleFi video games, staking, deflation, and reward tiers, it ensures customers have causes to remain.

- With CommunityFi, customers earn cash for holding and for spreading the phrase and including worth to the neighborhood.

This trifecta makes APORK a hybrid: half meme, half GameFi, half DeFi.

Solana’s memecoin sector exploded in late 2023 and early 2024 due to the platform’s ultra-low charges, quick affirmation occasions, and powerful Telegram-native neighborhood assist. However most of those cash had been short-lived pumps with no actual matter. There have been only a few cash that timed its virality proper within the markets.

On this sense, APORK might be:

- Solana’s first GambleFi-meme hybrid

- A blueprint for sustainable memecoin design

Because the Solana market reveals maturity and saturation of previous memecoins, it absolutely seems to be like Indignant Pepe Fork might be the one to pump up the markets once more.

Disclosure: This content material is supplied by a 3rd get together. crypto.information doesn’t endorse any product talked about on this web page. Customers should do their very own analysis earlier than taking any actions associated to the corporate.