Ever puzzled how prevalent bank card fraud actually is in Australia? Or which age teams are most in danger? To resolve these questions, we’ve gone straight to the supply: the Australian Bureau of Statistics (ABS).

The ABS supplies a wealth of knowledge on fraud victimisation, however it may be laborious to grasp the story behind the numbers. So let’s dissect their newest launch: from state-by-state comparisons to the affect on completely different demographics, we’ll reveal the laborious numbers behind bank card fraud. The most effective factor is all this information is backed by the authority of the ABS.

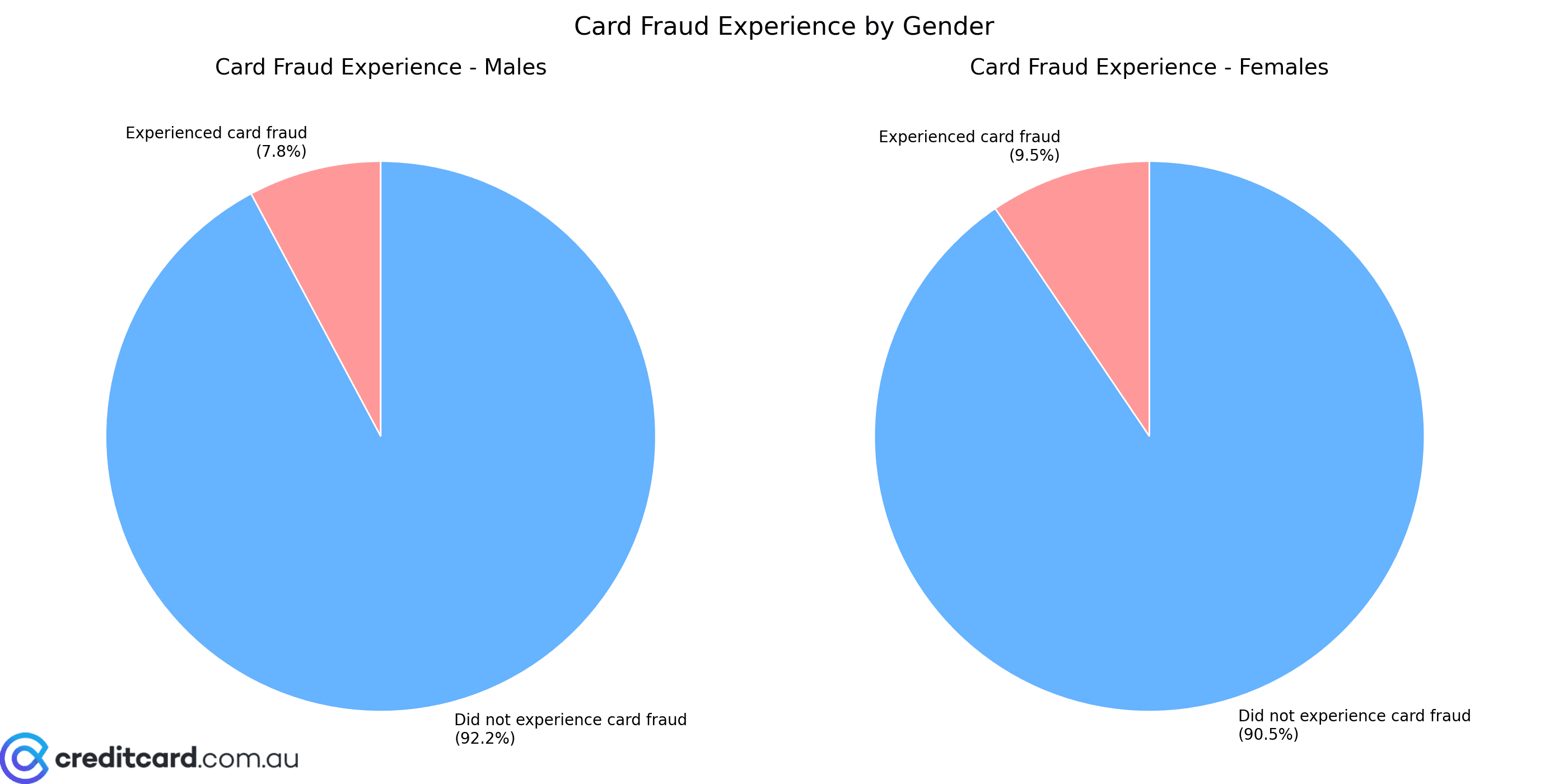

On first thought, it’s simple to imagine that bank card fraud impacts everybody equally. The ABS information means that’s not essentially the case. Once we look at the numbers by gender, we begin to see some attention-grabbing variations. Males are sitting at 7.8% of the inhabitants, with females at 9.5%. However what do these percentages imply in quantity type? Let’s take a more in-depth look.

🚨 Card Fraud Expertise 💳

Skilled Fraud 😭

| Gender | Rely |

|---|---|

| Males ♂️ | 799,000 |

| Females ♀️ | 1,005,700 |

| Whole 📊 | 1,807,200 |

Did Not Expertise Fraud 👍

| Gender | Rely |

|---|---|

| Males ♂️ | 9,428,200 |

| Females ♀️ | 9,615,200 |

| Whole 📊 | 19,040,700 |

Once we have a look at these slices of the pie, there’s a really shut hole. It paints the slight distinction within the share breakdown of female and male victims.

Past the gender breakdown the ABS information additionally supplies worthwhile insights into how card fraud victimisation varies throughout completely different Australian states. One key remark when trying on the state information is the sturdy correlation between inhabitants and reported card fraud incidents. The numbers scale with inhabitants which suggests bigger states report extra circumstances. Both method, there are nonetheless some attention-grabbing variations to discover.

🚨 Reported vs. Skilled Fraud (Australia) 🇦🇺

| Area | Reported Fraud | Skilled Fraud | All Individuals |

|---|---|---|---|

| New South Wales | 566,100 | 577,300 | 6,567,100 |

| Victoria | 476,600 | 486,500 | 5,389,800 |

| Queensland | 372,400 | 384,800 | 4,241,000 |

| South Australia | 108,900 | 110,900 | 1,477,500 |

| Western Australia | 150,900 | 161,000 | 2,211,400 |

| Tasmania | 34,300 | 35,200 | 466,300 |

| Northern Territory | 12,800 | 13,400 | 149,500 |

| Australian Capital Territory | 37,700 | 37,900 | 357,900 |

| Australia | 1,764,000 | 1,807,200 | 20,860,100 |

The ABS information additionally permits us to comply with the rising pattern of bank card fraud over the previous couple of years. The next graphs focuses on the time span from 2014-15 to 2022-23. We will see how the variety of reported incidents has modified throughout Australia’s states and territories. A number of financial and social elements might clarify the upward pattern in bank card fraud. The rise in on-line purchasing accelerated by COVID-19 could have offered extra alternatives for fraud. It’s attention-grabbing to notice that Western Australia noticed a decline in scams, which is refreshing to see!

Dangerous actors are additionally using superior strategies equivalent to AI-powered phishing and “deepfake” scams blurring the truth between rip-off and actuality. These are making it a lot tougher for shoppers and monetary establishments to detect and forestall fraud. This elevated sophistication possible performs a major function within the development in reported incidents.

To additional illustrate the regional variations in bank card fraud, we created this interactive map of Australia. By hovering your mouse over every state or territory (or tapping the state), you possibly can see the particular victimisation price. You’ll be capable of see a fast and visible technique to evaluate the affect of fraud throughout the nation. The darker the shade of purple, the upper the victimisation price.

Past regional variations, the ABS information additionally reveals vital variations in card fraud victimisation throughout completely different age teams. The info means that people within the 35-54 age vary are notably focused by bank card fraud. This may very well be as a consequence of their increased on-line exercise, better monetary property, and susceptibility to stylish phishing and identification theft schemes. The 65+ demographic has a decrease victimisation price then the center age teams, and this can be as a consequence of reluctance to report scams.

Skilled Card Fraud (Final 12 Months)

| Age Vary (years) | All Individuals | Victimisation Price (%) |

|---|---|---|

| 15—24 | 122,200 | 3.9 |

| 25—34 | 312,700 | 8.5 |

| 35—44 | 386,400 | 10.8 |

| 45—54 | 372,000 | 11.5 |

| 55—64 | 299,600 | 10 |

| 65 and over | 307,500 | 7.2 |

As we’ve seen the information from the ABS supplies a reasonably sobering snapshot of the present panorama. It clearly highlights the necessity for steady adaptation and enchancment in fraud prevention methods. The info reveals variations throughout gender, area, and age. These general numbers are regarding, however understanding these tendencies is step one in the direction of prevention. In case you’d wish to study extra on the best way to shield your self on-line, you possibly can learn my information to bank card identification theft safety.

Supply: ABS Private Fraud Statistics