Throughout the globe, individuals felt the turbulence of April. However at Bondora, we saved offering steady development for our traders. 2,314 new traders joined Bondora, and Go & Develop investments climbed considerably, proving how our neighborhood continues to decide on steady funding alternatives.

And with the Go & Develop seventh birthday celebration in its last weeks, now’s the time to leap in, make investments, and enter the €35,000 prize draw to win one thing extraordinary!

Prepared for the numbers? Let’s dive in:

In April, 2,314 new traders joined Bondora to develop their wealth with ease. Welcome to the world of easy investing!

Pssst. Do you know, you’ll be able to earn much more throughout our birthday celebration for every profitable referral? When your good friend begins investing earlier than 4 June by way of your referral code, you each can earn €25 every.

One of the best half? The extra buddies you invite, the extra probabilities somebody in your circle may win that dream journey, and perhaps take you with them!

👉 Invite a good friend and earn €25 >>

In April, traders added €30,082,562 to their Go & Develop accounts, a formidable 13.4% enhance from March’s €26,516,535. This enhance reveals simply how a lot pleasure the seventh Birthday Celebration is producing.

However time is operating out! The marketing campaign ends on 4 June, so now’s the right second to speculate extra into your Go & Develop. Each €100 you make investments earns you a raffle ticket for an opportunity to win your share of €35,000 in prizes! Assume Maldives. Assume money. Assume celebration. 🌴

👉 Make investments earlier than 4 June and be a part of the celebration!

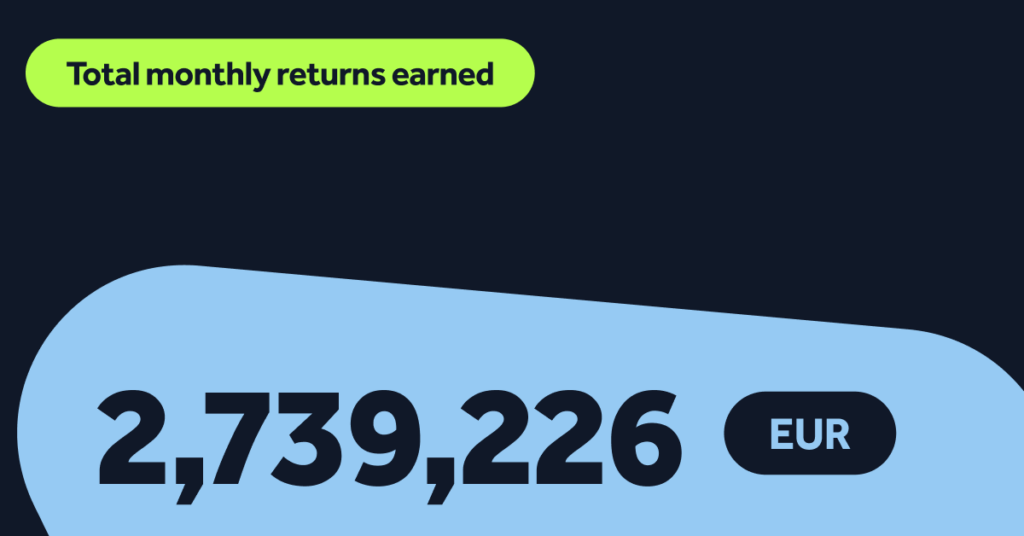

Buyers earned €2,739,226 in returns in April, which is a powerful efficiency even after March’s record-setting month. Constant development and earnings proceed to point out the reliability of Go & Develop.

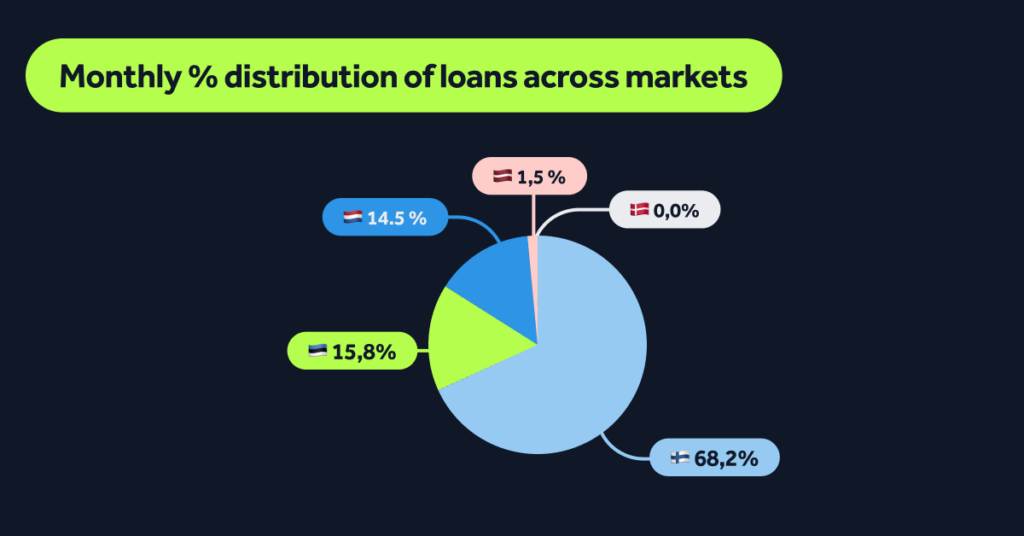

Mortgage origination stats – April 2025

In distinction to March’s peak, complete mortgage originations quickly dipped in April. Bondora AS issued €19,163,154 in loans, down 37.6% from March’s €30,701,100. This short-term dip got here as we optimized our advertising and marketing spend in the course of the first a part of the month, which led to fewer new debtors.

The excellent news is that volumes picked up once more towards the tip of April, and we’re already seeing the same old tempo return throughout our markets.

🇫🇮 Finland continued to dominate with €13,071,323 in mortgage originations, quickly down 37.0% from March.

🇳🇱 The Netherlands adopted with €3,019,224, 34.3% decrease than the earlier month.

🇪🇪 Estonia originated €2,776,410 in loans, 41.4% lower than in March.

🇱🇻 Latvia originated €295,380 in loans, a 36.3% lower.

🇩🇰 Denmark issued €816 in loans in April, down from its first month in March. Along with our advertising and marketing spend optimization, small volumes and early fluctuations are anticipated in a brand-new market.

Right here’s how April’s mortgage origination shares stacked up:

- Finland: 68.2%

- Netherlands: 15.8%

- Estonia: 14.5%

- Latvia: 1.5%

- Denmark: 0.0%

Should you’re curious in regards to the larger image, our deep dive into our 2024 Monetary Report has all the pieces you want. We clarify our newest report’s numbers, development traits, and insights.

📊 Deep dive into the report evaluation right here >>

Not following us on Instagram, Fb, or LinkedIn but? Be part of us there for extra updates, useful content material, and a peek into life at Bondora!

Do you may have any questions on investing with Bondora? Our CEO and co-founder, Pärtel Tomberg, just lately answered the most-asked investor questions in our annual Q&A video. It’s filled with insights and behind-the-scenes context you don’t wish to miss.