Motive to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by trade consultants and meticulously reviewed

The very best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

A rising refrain of Bitcoin commentators is elevating the alarm over the latest growth in publicly traded firms adopting Bitcoin-centric treasury methods. The controversy ignited this week after pseudonymous investor Stack Hodler (@stackhodler) described the pattern as a speculative mania disguised in company type, writing on X that “Bitcoin treasury firms are this cycle’s shitcoins.” His argument: these firms are “creating shares out of skinny air to promote to individuals hoping to outperform Bitcoin,” with little greater than publicity to BTC as their core product. “It’s simply TradFi shitcoinery,” he warned. “And plenty of will get rekt.”

Stack Hodler allowed that these firms are at present absorbing speculative liquidity which may in any other case chase illiquid altcoins. “However the dangerous information is that many of those companies will inevitably be pressured to dump their stacks sooner or later,” he added, pointing to the second when short-term traders notice that holding fairness in a Bitcoin proxy could also be much less environment friendly than self-custody. “Fiat shenanigans with the potential to unwind” was how he framed the mannequin. In distinction, he celebrated firms that generate actual financial worth and use their earnings to build up Bitcoin—one thing he views as a sustainable pressure in Bitcoin’s monetization arc.

Associated Studying

Bitcoin podcaster Stephan Livera entered the dialog by referencing MicroStrategy’s Q1 2025 earnings name, the place Michael Saylor laid out the rationale for the corporate’s persistent premium to internet asset worth. “Saylor outlined some causes for MSTR being at a a number of to NAV,” Livera mentioned. Whereas acknowledging the cyclical nature of that premium—evaluating it to the GBTC low cost blowout within the earlier cycle—he argued there’s a broader structural context. “Bitcoin is a $2 trillion asset in a world of $1,000 trillion in belongings,” Livera famous, emphasizing that many massive capital allocators stay unable to instantly maintain Bitcoin on account of regulatory, tax, or mandate-related restrictions. “There’s a case for some treasury firms to exist long-term, as long as they’re managed prudently.”

The Bitcoin Treasury Copy-Cat Surge

However Stack Hodler wasn’t referring to MicroStrategy. “I’m speaking concerning the copycats which might be popping up at an accelerating tempo,” he responded. “They’re making an attempt to draft off MSTR’s success, much like how shitcoins drafted off of BTC’s success.” He mentioned he doesn’t deny that regulatory arbitrage may assist a number of of those companies within the brief to medium time period, however questioned the viability of firms whose main exercise seems to be printing shares and utilizing the proceeds to purchase Bitcoin. “I really like seeing firms with actual worthwhile companies stack BTC. Fiat engineering appears shakier to me long-term.”

Scott Melker, host of “The Wolf of All Streets” podcast, added to the dialogue: “I hate to even assume this, as a result of I’m an enormous fan—however Bitcoin treasury firms elevating debt to purchase Bitcoin could possibly be the subsequent bubble.” Market construction analyst Dave Weisberger agreed that danger is current, however took a extra measured stance. “Positive. However bubbles should inflate earlier than we fear about them… spoiler, Bitcoin is NOT close to bubble territory.”

Technical analyst FiboSwanny, a 25-year market veteran, targeted on leverage and market construction. “If there’s a bubble forming, it’s possible within the monetary devices and leverage round Bitcoin,” he mentioned, citing debt-funded treasury purchases, ETFs, and derivatives. “Not in precise Bitcoin itself.” Lark Davis took a extra bearish tone: “That is our GBTC leverage this cycle that can have a horrific unwind with devastating penalties later. Particularly the businesses shopping for altcoins.”

Associated Studying

Swan CEO Cory Klippsten didn’t mince phrases both. “Already jumped the shark,” he wrote. “Have been predicting it for a 12 months, however it’s inevitable now.”

The present panorama consists of dozens of public firms with direct Bitcoin holdings, a few of that are drawing intense retail hypothesis. MicroStrategy stays the dominant pressure, with effectively over half 1,000,000 Bitcoin on its books. Different names embody Metaplanet in Japan, Semler Scientific, KULR Expertise, and varied new entrants who’ve reoriented their company missions solely round Bitcoin accumulation. Many of those companies are actually buying and selling at multi-billion-dollar valuations, far above what their underlying enterprise fashions would counsel.

However the sustainability of the mannequin stays in query. Most of those firms depend on issuing new fairness at inflated valuations to finance additional Bitcoin purchases, making a reflexive cycle the place rising BTC costs inflate share costs, which in flip allow extra shopping for. That dynamic works fantastically in a bull market however can reverse shortly in a downturn.

The controversy over how institutional publicity is structured turns into more and more related. Stack Hodler framed it merely: “Bitcoin is and at all times would be the finest risk-return asset to carry on this area. A part of efficiently holding Bitcoin is having the ability to withstand all of the ‘higher Bitcoins’ that inevitably come up throughout your journey.” Whether or not the brand new class of treasury firms represents innovation, opportunism, or just a bubble ready to burst, stays one of many key questions of this cycle.

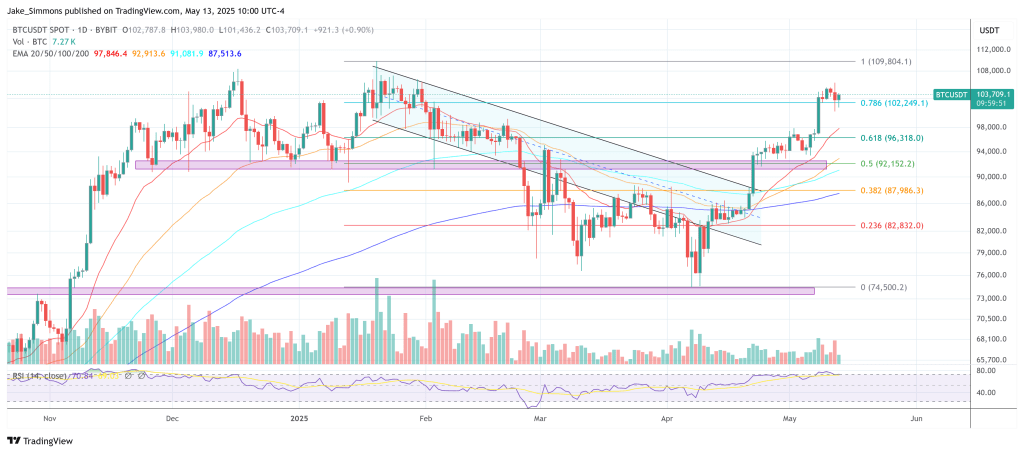

At press time, BTC traded at $103,709.

Featured picture created with DALL.E, chart from TradingView.com