Cryptocurrencies regained footing on Monday after a rocky begin to the buying and selling session, mirroring a broader restoration in danger property as merchants digested Moody’s downgrade of U.S. authorities bonds.

Bitcoin

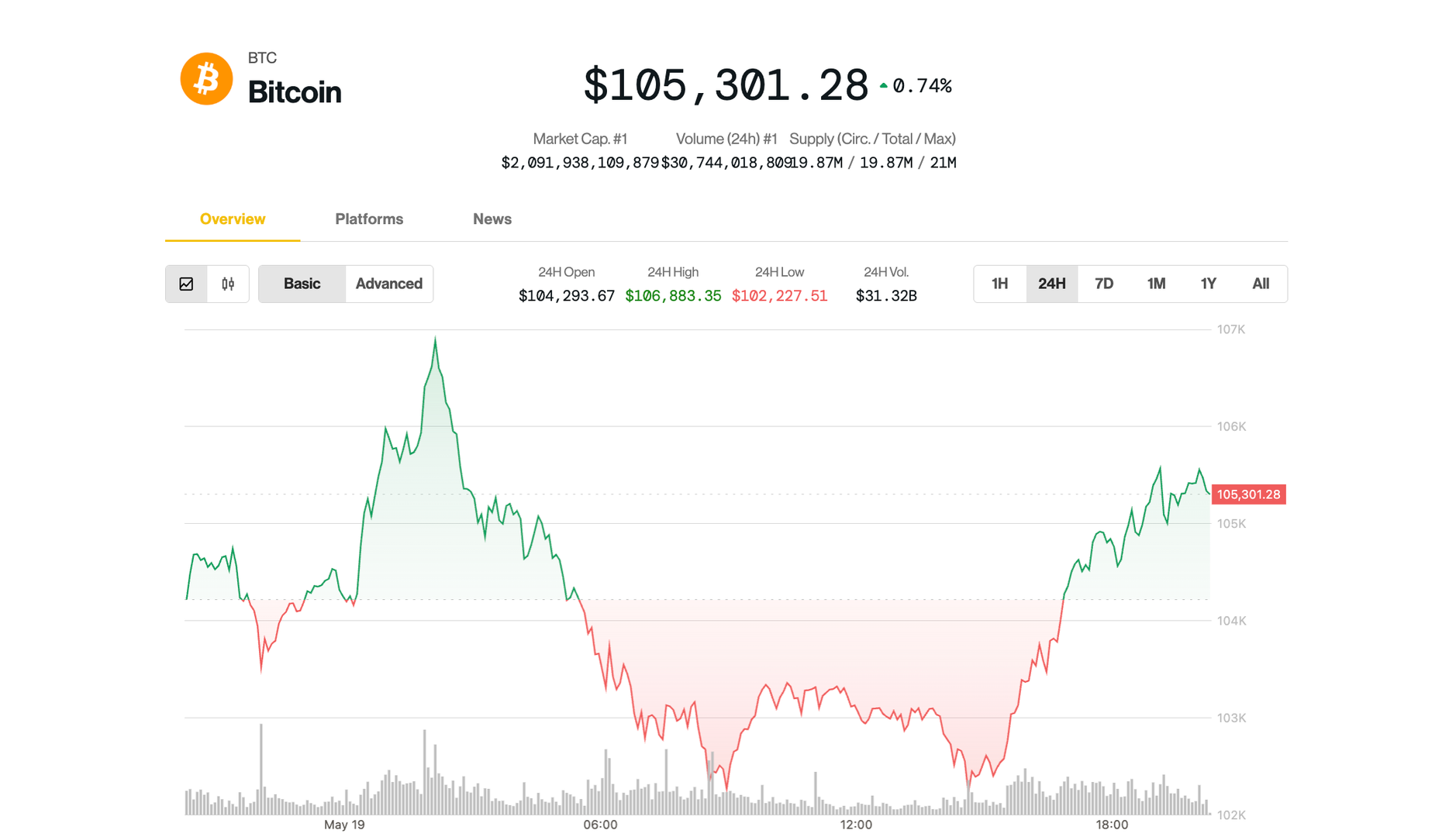

notched a robust rebound after slipping to as little as $102,000 early within the U.S. session, following its document weekly shut at $106,600 in a single day. The biggest cryptocurrency by market cap climbed again to $105,000 in afternoon buying and selling, up 0.4% over 24 hours. Ether rose 1.2%, reclaiming the $2,500 degree.

DeFi lending platform Aave

outperformed most large-cap altcoins, whereas nearly all of the broad-market CoinDesk 20 Index members nonetheless remained within the crimson regardless of advancing from their day by day lows. Solana , Avalanche and Polkadot had been down 2%-3%.

The bounce prolonged to U.S. shares, too, with the S&P 500 and Nasdaq erasing their morning decline.

The early pullback in crypto and shares got here after Moody’s late Friday downgraded the U.S. credit standing from its AAA standing. The transfer rattled bond markets, pushing 30-year Treasury yields above 5% and the 10-year observe to over 4.5%.

Nonetheless, some analysts downplayed the downgrade’s long-term impression on asset costs.

“What does [the downgrade] imply for markets? Longer-term – actually nothing,” stated Ram Ahluwalia, CEO of wealth administration agency Lumida Wealth. He added that within the brief time period there could be some promoting stress centered on U.S. Treasuries resulting from massive institutional buyers rebalancing, as a few of them are mandated to carry property solely in AAA-rated securities.

“Moody’s is the final of the three main score companies to downgrade U.S. debt. This was the other of a shock – it was a very long time coming,” Callie Cox, chief market strategist at Ritholtz Wealth Administration, stated in an X put up. “That’s why inventory buyers don’t appear to care.”

Bitcoin targets $138K this yr

Whereas BTC hovers just under its January document costs, digital asset ETF issuer 21Shares sees extra upside for this yr.

“Bitcoin is on the verge of a breakout,” analysis strategist Matt Mena wrote in a Monday report. He argued that BTC’s present rally is pushed not by retail mania, however by a confluence of structural forces, together with institutional inflows, a historic provide crunch and enhancing macro circumstances that means a extra sturdy and mature path to contemporary all-time highs.

Spot Bitcoin ETFs have persistently absorbed extra BTC than is mined day by day, tightening provide whereas main establishments, companies similar to Technique and newcomer Twenty One Capital accumulate and even states discover creating strategic reserves.

These components mixed might carry BTC to $138,500 this yr, Mena forecasted, translating to a roughly 35% rally for the biggest crypto.