Marriott Bonvoy Boundless Credit score Card overview

Even in the event you aren’t a Marriott loyalist, the Marriott Bonvoy Boundless® Credit score Card (see charges and costs) is price contemplating. It comes with an annual free evening and elite evening credit however carries a decrease annual charge than most different playing cards within the Marriott card lineup. Card ranking*: ⭐⭐⭐⭐

*Card ranking is predicated on the opinion of TPG’s editors and isn’t influenced by the cardboard issuer.

Marriott presents a various bank card portfolio issued by each Chase and American Categorical. Nevertheless, the Marriott Bonvoy Boundless Credit score Card from Chase stands out as the one mid-tier private Marriott Bonvoy card out there to new candidates.

With an annual charge of $95 and a really useful credit score rating of 670 or greater, the Boundless lands simply above the lowest-tier Marriott Bonvoy Daring® Credit score Card (see charges and costs). Even those that keep at Marriott properties sometimes can profit from this card’s helpful welcome bonus, annual free evening and elite evening credit.

Let’s take a better have a look at whether or not the Marriott Bonvoy Boundless could be a very good addition to your pockets.

Marriott Bonvoy Boundless execs and cons

| Professionals | Cons |

|---|---|

|

|

Marriott Bonvoy Boundless welcome provide

For a restricted time, new candidates for the Marriott Bonvoy Boundless can earn 5 free nights (every evening valued at as much as 50,000 factors, for a complete potential worth of as much as 250,000 factors) after spending $5,000 on purchases within the first three months from account opening. Sure lodges have resort charges.

TPG’s June 2025 valuations peg Marriott Bonvoy factors at 0.7 cents every, making this bonus price as much as $1,750 in the event you totally max out every evening at 50,000 factors (for a complete of 250,000 factors).

This matches the best welcome bonus we have seen on this card, which is often provided as soon as within the first half of the yr. When you’ve been contemplating including this card to your pockets, now could be the perfect time to use.

It is also necessary to notice the eligibility necessities for this card:

Day by day Publication

Reward your inbox with the TPG Day by day e-newsletter

Be part of over 700,000 readers for breaking information, in-depth guides and unique offers from TPG’s consultants

- To be accredited, you may must be below the Chase 5/24 rule since this card is issued by Chase.

- Moreover, Marriott cobranded playing cards are identified for having strict and considerably complicated eligibility necessities, and sadly, the Boundless is topic to those guidelines.

Earlier than submitting an utility, remember to verify the eligibility necessities. These eligibility necessities sometimes require you to not have obtained a welcome bonus on one other Marriott or former Starwood Most popular Visitor bank card for a sure time frame. Moreover, in the event you presently maintain a Marriott cobranded card, you might not be eligible for the welcome bonus now.

Associated: An entire information to the Marriott Bonvoy resort loyalty program

Marriott Bonvoy Boundless advantages

The Bonvoy Boundless comes with a $95 annual charge, nevertheless it ought to be simple to get a number of hundred {dollars} in worth out of the cardboard’s perks yearly. Listed below are the key ones to think about:

Anniversary free evening award

Every year, on account renewal, you may obtain a free evening certificates price as much as 35,000 factors. You may as well high off your certificates with as much as 15,000 further factors, making it probably price 50,000 factors.

TPG’s June 2025 valuations peg the worth of 35,000 Marriott factors at $245, almost thrice the $95 annual charge. Nevertheless it’s attainable to get much more worth in the event you’re selective about redeeming your reward evening.

TPG senior lodges reporter Tanner Saunders says, “I’ve discovered that my Boundless card virtually pays for itself for the reason that annual free evening award shortly covers the $95 annual charge. Add that to the very fact the cardboard helps you earn so many factors on each greenback spent, and I have been ready to make use of the factors I earned with the assistance of the cardboard for some nice stays, together with two nights in a one-bedroom suite at a resort in Atlanta the place charges have been sky-high after I went to see Taylor Swift.”

Elite standing

With the Bonvoy Boundless, you may earn computerized Silver Elite standing, which comes with 10% bonus factors on stays and precedence late checkout.

The cardboard additionally presents a path to Gold Elite standing: spending $35,000 on purchases every calendar yr. Nevertheless, in order for you a card that gives complimentary Gold Elite standing with Marriott, contemplate The Platinum Card® from American Categorical or The Enterprise Platinum Card® from American Categorical (enrollment is required; phrases apply).

Though you possibly can unlock Gold Elite standing by way of spending, you are most likely higher off incomes greater standing organically by way of the cardboard’s complimentary 15 elite evening credit in addition to some stays booked straight with Marriott. So, with Boundless’ 15 nights, you’d solely want to remain 35 nights (as an alternative of fifty) to earn Platinum Elite standing.

When you have the Bonvoy Boundless and a Marriott enterprise card just like the Marriott Bonvoy Enterprise® American Categorical® Card, you will get 30 elite evening credit every year simply from bank cards, leaving solely 20 nights to go to achieve Platinum Elite.

One other pathway towards greater standing is incomes one elite evening credit score for each $5,000 you spend on purchases with the cardboard.

Different perks

The above advantages signify a number of hundred {dollars} in worth every year and simply make up for the $95 annual charge. However the card additionally presents a number of further perks:

- Baggage delay insurance coverage: If a passenger service delays your baggage for over six hours, Chase could reimburse you for important purchases as much as $100 a day for 5 days.

- Misplaced baggage reimbursement: If a passenger service damages or loses your checked or carry-on baggage, Chase could reimburse you as much as $3,000 per coated traveler.

- No overseas transaction charges: This perk makes the Bonvoy Boundless best for making purchases and reserving resort stays world wide.

- Buy safety: Chase covers most new purchases for 120 days towards injury or theft, as much as $500 per declare (capped at $50,000 per account).

- Journey delay reimbursement: If you’re delayed by greater than 12 hours or required to remain in a single day when touring on a typical service, Chase could reimburse you for choose, in any other case unreimbursed bills, as much as $500 per coated traveler.

Incomes factors on the Marriott Bonvoy Boundless

The Marriott Bonvoy Boundless card earns factors on the following charges:

- 6 factors per greenback spent on eligible purchases at lodges collaborating within the Marriott Bonvoy program (you may earn as much as 17 factors per greenback spent on eligible Marriott stays: 10 factors from being a Bonvoy member, 6 factors from this card and 10% bonus factors from the Silver Elite standing the cardboard gives, which equates to a complete 11.9% return on spending primarily based on TPG’s June 2025 valuations)

- 3 factors per greenback on the primary $6,000 spent in mixed purchases every year on eating and at gasoline stations and grocery shops

- 2 factors per greenback spent on all different purchases

The bonus factors you earn because of the complimentary elite standing that comes with this card may be helpful — particularly in the event you’re dedicated to incomes Marriott Bonvoy factors.

Nevertheless, different playing cards — just like the Chase Sapphire Reserve® (see charges and costs) — can provide you a higher return in your Marriott resort stays.

Redeeming factors on the Marriott Bonvoy Boundless

After all, the obvious technique to redeem Marriott Bonvoy factors is for resort stays. There are a number of methods for maximizing your Marriott redemptions, however that is essentially the most easy.

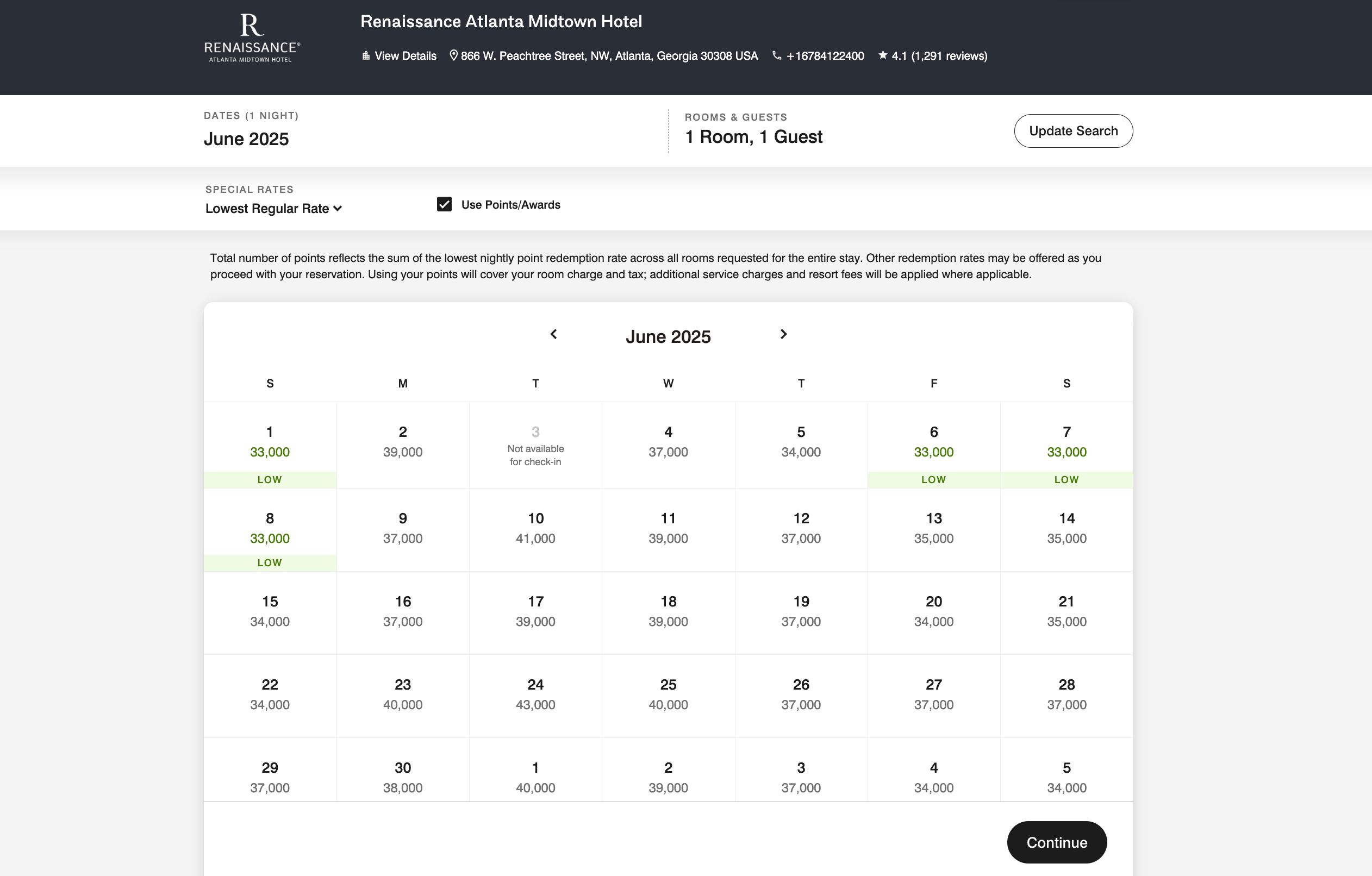

Marriott Bonvoy makes use of dynamic pricing for its award nights, which suggests the variety of factors wanted to redeem fluctuates given demand and availability.

Utilizing Marriott’s award calendar search operate may help you discover the perfect deal when redeeming your factors. As an illustration, an evening on the Renaissance Atlanta Midtown Resort may run you as little as 33,000 factors within the first week of June however as much as 43,000 factors per evening later within the month.

Redemption charges at Marriott properties additionally fluctuate relying on which model you stick with. For instance, an evening on the enterprise traveler-focused Courtyard Paris Gare de Lyon in June may value 65,000-68,000 factors, whereas the luxurious The St. Regis Bora Bora Resort prices 128,000-140,000 factors per evening for a similar dates.

One other necessary issue to notice is that you’re going to wish to benefit from the fifth evening free on award stays (often known as “Keep for five, Pay for 4”) every time attainable. For each 5 consecutive nights you keep at a Marriott property utilizing factors, you may obtain the evening that is well worth the lowest variety of factors at no cost. It is a robust technique to make your factors stretch additional on longer stays.

TPG bank cards author Chris Nelson used this fifth-night-free perk on a keep on the Aloft Bali Seminyak resort, the place he redeemed simply 50,500 factors for 5 nights.

Associated: Maximize your resort factors by getting a fourth or fifth evening free on award stays

Transferring factors on the Marriott Bonvoy Boundless

Marriott allows you to switch factors to just about 40 airline companions, together with some with hard-to-earn currencies like Frontier Airways and Korean Air. Most transfers are at a 3:1 ratio, with a 5,000-mile bonus for each 60,000 factors transferred.

Whereas this may be helpful for topping off an account or reserving an award flight, it is normally not the perfect use of Bonvoy factors — particularly since most transfers take a number of days, and award area could disappear earlier than your switch completes.

TPG bank cards author Danyal Ahmed makes use of his Bonvoy factors to high off his American Airways AAdvantage account when in want of some further miles for high-value redemptions, comparable to on Qatar Airways’ award-winning Qsuite.

Associated: Marriott Bonvoy program: How one can redeem factors for resort stays, airfare and extra

Which playing cards compete with the Marriott Bonvoy Boundless?

If you need extra Marriott Bonvoy perks or extra versatile rewards, you might discover certainly one of these playing cards to be a greater match:

For extra choices, try our full record of the greatest Marriott Bonvoy bank cards and greatest resort bank cards.

Associated: 3 explanation why the Marriott Bonvoy Boundless is well worth the $95 annual charge

Backside line

The Marriott Bonvoy Boundless presents strong worth for its $95 annual charge, with perks normally discovered on costlier playing cards — like an annual free evening price $200-$300.

It is a good match for Marriott followers who wish to keep away from excessive charges, however be aware of the strict bonus guidelines and Chase’s 5/24 limits.

When you’ve already accomplished the Chase Trifecta and qualify for the bonus, this card generally is a good addition to your pockets.

Apply right here: Marriott Bonvoy Boundless Credit score Card

For charges and costs of the Marriott Bonvoy Good Amex, click on right here.

For charges and costs of the Marriott Bonvoy Bevy Amex, click on right here.