The HDFC Multicurrency Foreign exchange Card is designed to be a handy journey companion for frequent worldwide travellers. Designed to carry a number of foreign currency in a single card, it eliminates the effort of carrying money or managing a number of foreign money wallets.

With zero foreign exchange markup for same-currency transactions and extensive world acceptance, this pay as you go journey card is an economical various to utilizing a typical debit or bank cards overseas.

On this evaluation, we’ll dive into its options, charges, and whether or not it’s the correct selection in your journey wants.

Charges & Costs

| Kind | Pay as you go Foreign exchange Card |

| Issuance Charge | 500 INR + GST |

| Reload Charge | 75 INR + GST |

| Foreign money Supported | – Multi-Foreign money Pockets – Helps 22 Currencies |

| Utilization | – POS / Contactless – ATM – On-line |

| Foreign exchange Markup Costs (For Load/Re-load) |

~2.5% (Financial institution says no expenses) |

| Cross foreign money markup Costs | – 2% (pockets to pockets switch) – 2% (when funds low on one pockets) |

| Every day ATM withdrawal Restrict | USD 5,000 (or equal) |

| TCS | – Nil upto 7L per FY – 20% past 7L per FY (objective: private spends) |

| Reload Technique | Consumer pleasant, by way of On-line Portal |

The way it works?

The HDFC Multicurrency ForexPlus Card allows you to load a number of currencies onto a single card, performing like a digital pockets for hassle-free worldwide spends.

You possibly can load and reload funds as wanted, making it a versatile choice for frequent travellers. Right here’s a pleasant video by the financial institution on how the cardboard works.

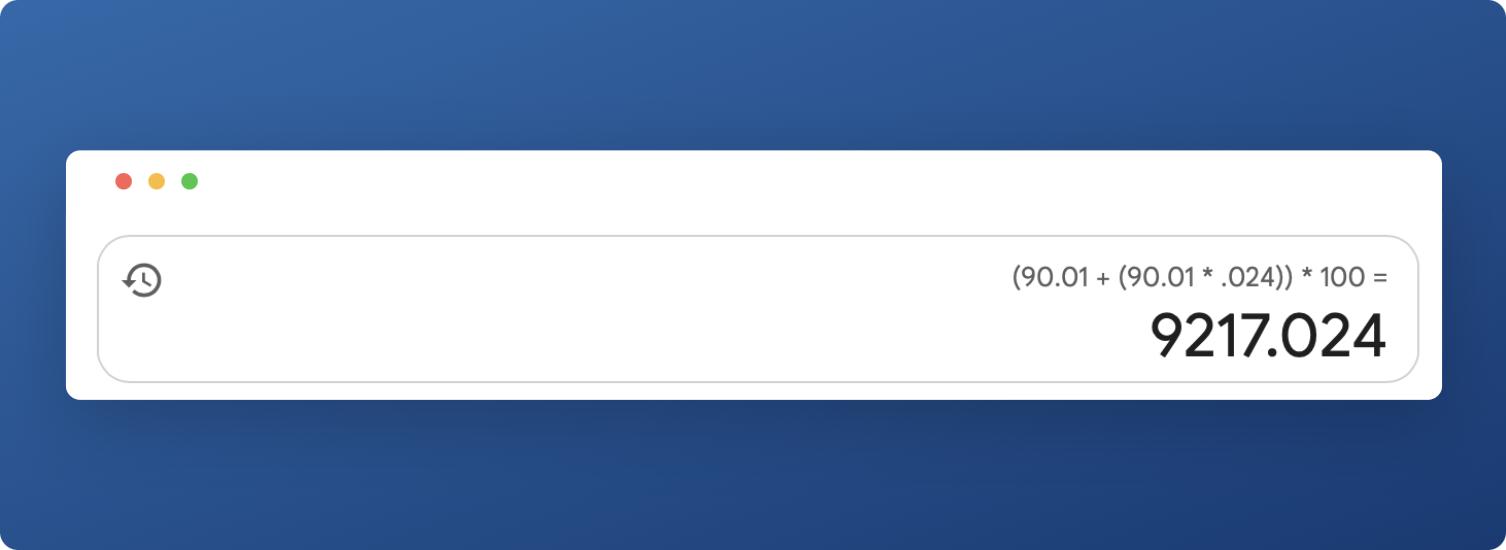

Whereas HDFC markets this card as having 0% foreign exchange expenses, it’s essential to notice {that a} ~2.4% markup is already utilized on the time of loading.

So, when you keep away from transaction charges on same-currency spends, the conversion value is constructed into the trade fee. Right here’s a deeper have a look at the way it works.

Palms on Expertise

I’ve talked about hidden expenses on load/reload earlier than – again after I first wrote this text ~8 years in the past.

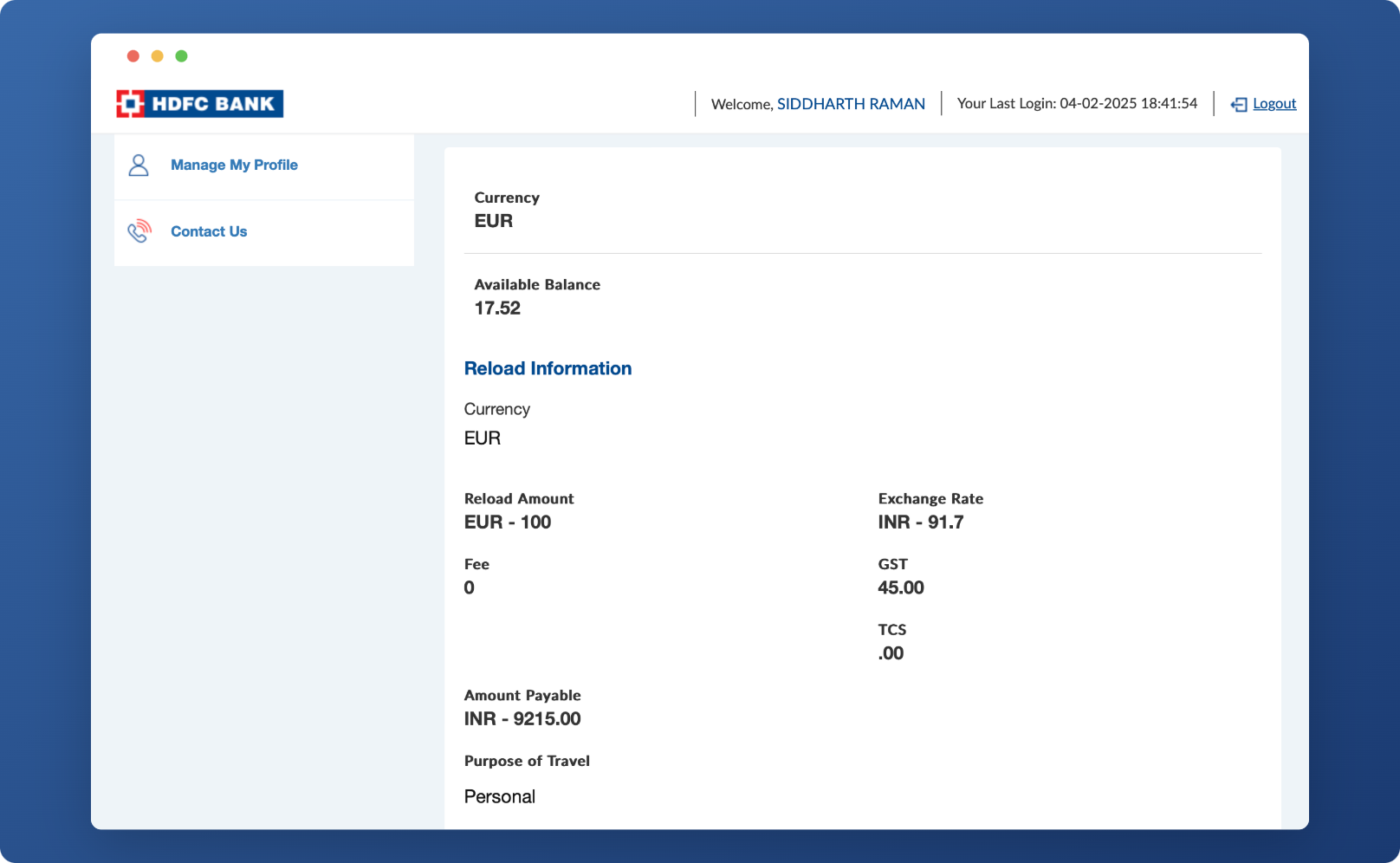

However not too long ago, I obtained the HDFC Multicurrency Foreign exchange Card myself, and right here’s a stay instance of the particular distinction in expenses as we speak:

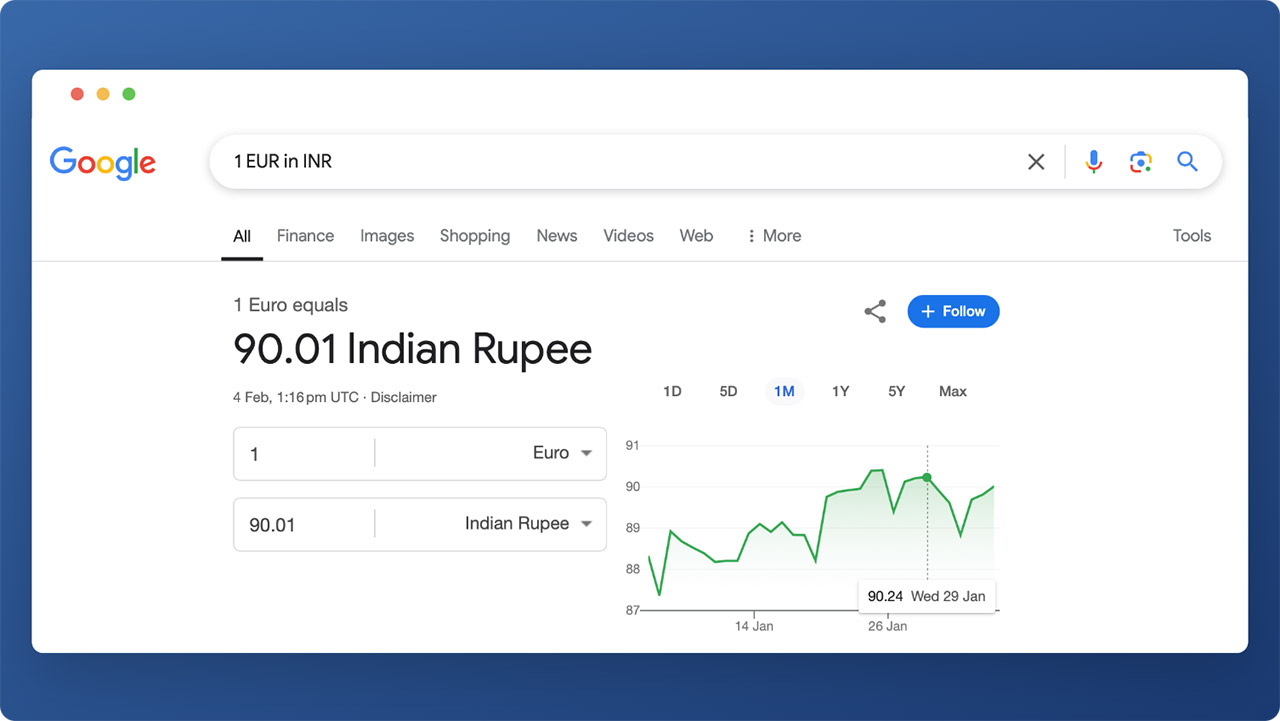

- 1 EUR in INR (as on google.com): 90.01 INR

- 1 EUR in INR (HDFC fee): 91.7 INR

- Distinction together with expenses: ~2.4% (hidden markup charge)

That’s roughly a 2.4% markup charge – nowhere talked about by the financial institution – however in step with the lowest foreign exchange markup on HDFC’s super-premium bank cards like Infinia.

Nonetheless, needless to say the HDFC Multicurrency Foreign exchange Card could be an costly selection when you’re touring to a rustic the place the native foreign money isn’t supported.

In that case, you’ll get hit with markup charges twice – as soon as whereas loading the cardboard and once more whereas spending.

5X/10X Rewards

The HDFC Foreign exchange Card gained reputation between 2016-2018, because of profitable reload affords on HDFC Financial institution bank cards – together with 1% cashback, 5X rewards, and even 10X rewards.

Nonetheless, these affords stopped for practically 5 years. Now, in 2025, HDFC has lastly introduced them again.

A 5X rewards promo on foreign exchange reloads is at the moment energetic (Jan-March 2025), right here’s hyperlink to t&c. Because it hasn’t been broadly examined but, it’s greatest to load a small quantity first and verify for rewards within the first week of subsequent month earlier than going all in.

Whereas that’s good, it’s to be famous that I didn’t even obtain 1X factors on my check load of 100 EUR when the provide was not stay.

Do you have to take it?

It depends upon the wants. For many, 0% foreign exchange debit playing cards like IndusInd Pioneer or IndusInd Unique debit playing cards are adequate.

However If there are reload affords like 5X rewards, it does make sense to go for it though the financial institution expenses ~2.4% charge, as it would nonetheless end in web acquire.

On different aspect, when you maintain HDFC Infinia and has solely POS spends and don’t require Money withdrawal choice, you’re higher off with the Infinia Credit score Card with World Worth Program enabled so that you just’ll not solely get 3.3% rewards but in addition further 1% cashback on the spends.

Bottomline

The HDFC Multicurrency Foreign exchange Card is simple to use for, load, and use, nevertheless it comes with hidden expenses that aren’t explicitly talked about by the financial institution. That stated, it’s nonetheless a first rate choice when you’re visiting just a few choose international locations.

Nonetheless, when you journey to a number of international locations regularly, a 0% foreign exchange debit card is a a lot better selection – eliminating advanced calculations and double markup charges. Merely withdraw native foreign money from any financial institution ATM overseas, identical to I’ve been doing for the previous eight years.

Personally, I used to depend on the IndusInd Unique Debit Card, however I’ve now switched to the IndusInd Pioneer Debit Card – each of which have zero expenses on foreign exchange transactions, together with markup and ATM withdrawals. This makes my travels fully cashless, hassle-free, and cost-effective.

What’s your expertise with Foreign exchange Playing cards? Be happy to share your ideas within the feedback under!